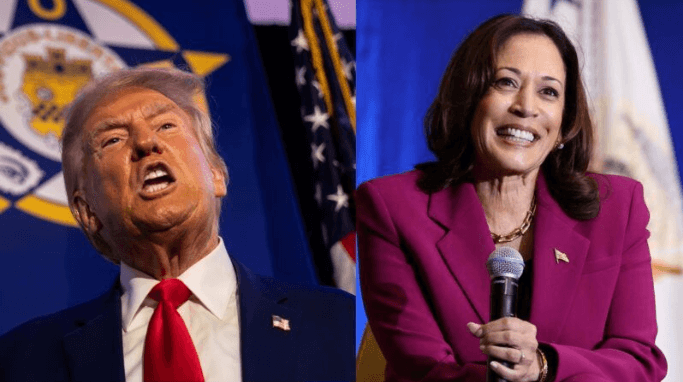

Former President Donald Trump touted his tax plan ideas at his campaign, claiming the country would make so much money if he were re-elected. In fact, it would add trillions to the national debt. It would be devastating, as he already set all records for blowing a hole in the deficit, which is extraordinary. During his four years, he added more to the national debt than any president before him, even more than the aggregate combination of all 44 presidents that preceded him. This is despite his promise to balance the budget and pay down the debt. Now, it seems the situation could get worse.

Analysis of the National Debt

For a closer look at the national debt and the economic plans from both Trump and Vice President Kamala Harris, Steve Rattner, a former Treasury official and “Morning Joe” economic analyst, joins the discussion. He remarks that, unfortunately, during this century, neither party has paid much attention to the national debt. He recalls that when he left Congress in 2001, there was a $155 billion surplus, and the national debt was about $5 trillion. Now, it’s $35 trillion. Any hope of reversing this trend from the proposed programs of either candidate? Reversing would be too strong a word, Rattner notes, but he believes Harris’s plan is preferable.

How the U.S. Reached the Current Debt Crisis

Rattner provides some context, explaining how the country got into its current situation. In 2007, before the financial crisis, the Congressional Budget Office (CBO) projected that the debt-to-GDP ratio, which measures the sustainability of debt, would drop to 20%. This now seems quaint. The financial crisis changed everything. Since then, every year, the CBO has projected higher debt than previously thought. As a result, the country is now facing the possibility of reaching 120% debt-to-GDP on its current course. This would be the highest in recent history, even surpassing World War II levels, when a large amount of debt was necessary for critical reasons.

From Surplus to Deficit: The Political Factors

Rattner recalls that when Bill Clinton left office, the country had a surplus. However, during the first year of George W. Bush’s presidency, with tax cuts and the Iraq War, the deficit began to rise. While it came down slightly, the financial crisis struck, and the deficit spiked. President Obama worked hard to reduce the deficit, but it began to rise again under Trump even before COVID-19 hit. Under Biden, the deficit has come down somewhat, but the debt is still a looming issue as we head into the next campaign.

Trump’s Economic Plan and Its Impact on Debt

Next, Rattner compares the economic plans of Trump and Harris. Trump’s plan would extend all his tax cuts, including those for the wealthy, exempt Social Security from income tax, eliminate taxes on tips, and lower corporate taxes. While Trump wants to repeal green energy tax credits, these measures would add $5.2 trillion to the national debt over the next decade. Trump suggests tariffs to offset the debt, but most experts do not believe these tariffs would actually materialize. As a result, Trump’s plan would likely add $2.6 trillion to the debt.

Harris’s Economic Plan: A More Sustainable Approach

In contrast, Harris’s economic plan is designed to pay for itself. Her plan favors average Americans, offering tax cuts for those earning less than $400,000, while the wealthy and corporations would be expected to pay their fair share. This would raise corporate taxes and help limit the addition to the national debt. While Harris’s plan wouldn’t entirely solve the debt problem, it would at least avoid making it worse, adding only a trivial amount to the deficit.

How Harris Limits the New Debt

Looking at the data, Rattner shows that Trump would add $5.2 trillion to the national debt without the unlikely tariffs, while Harris would add essentially nothing. This comparison becomes stark when you look at the debt added during Trump’s term, which totaled $8.4 trillion, including $3.6 trillion related to COVID-19. Even without COVID-related debt, Trump added $4.8 trillion. Biden has added significantly less debt, and Harris’s plan is positioned as a more fiscally responsible approach.

Harris: The Most Fiscally Conservative President of This Century?

Rattner notes that if Harris only added a trivial amount to the national debt, as projected, she would be the most fiscally conservative president of this century, compared to George W. Bush, Barack Obama, Donald Trump, and Joe Biden. This is a remarkable point given the growing national debt under recent administrations.

Revenue vs. Spending: The Core Problem

Rattner closes by pointing out that while Harris’s plan is commendable, the U.S. still faces a fundamental problem: tax revenues are below the 50-year average, while spending is above it. This imbalance is unsustainable, and the country can’t continue to run with revenues consistently lower than expenses. Rattner emphasizes that while Clinton managed to achieve a budget surplus with higher revenues than spending, the U.S. is now in a very different position, with spending far outpacing revenue.

The National Debt Crisis and the Looming Danger

Rattner also warns about the long-term dangers of the rising national debt. Eventually, he explains, the debt will reach a tipping point where markets will no longer want to hold U.S. debt, causing interest rates to spike and triggering a financial crisis. This would lead to a rise in interest costs that could crowd out other important federal spending, potentially even affecting programs like Social Security and Medicare.

Conclusion: A Time to Act

In closing, Rattner stresses that while the country still has time to address the national debt issue, the window is closing. Once the debt crisis hits, it will be too late to act. He remarks that progressive economists have long mocked concerns about the impact of big spending on interest rates and economic pain. However, as the recent economic trends have shown, these concerns are real, and action is needed to prevent a future crisis.

Final Thoughts from the Hosts

The hosts agree that the current trajectory of the national debt is unsustainable, and they commend Harris’s plan for offering a fiscally responsible approach. However, they also acknowledge the urgent need for long-term reforms to address the core issue of rising spending and insufficient revenue.